travel nurse taxes in california

According to Emil Belvin a tax. You may need to pay four taxes as an independent contractor.

Trusted Guide To Travel Nurse Taxes Trusted Health

TravelTax specializes in tax preparation for travel nurses and other travel professionals in healthcare IT engineering nuclear Canadian international foreign missionaries and.

. This is the most common Tax Questions of Travel Nurses we receive all year. Deciphering the travel nursing pay structure and tax rules can be complicated. At Travel Nurse Tax we are an independent tax preparation firm and our focus is on the tax needs of travelers and non-travelers alike.

The average salary for a travel nurse is 2224 per week in California. It is also the most important since the determination of whether per diems. The following nine tips can make filing your travel.

Travel Nurse Tax Pro based in southern California is an experienced tax preparation firm that focuses on preparing tax returns for travel nurses and other mobile healthcare professionals. A couple of options for tax professional that specializes in travel nurse taxes includes. You will often hear people assert that California has the best pay.

What taxes do travel nurses pay. Here are some categories of travel nurse tax deductions to be aware of. The fact that the income was not earned in the home state is irrelevant.

A blended rate combines an hourly taxable wage such as 20 an hour with your non-taxable reimbursements and stipends to give you a higher hourly rate. May 9 2019. Under the new 2018 tax laws travel nurse tax deductions or write-offs are no longer available.

This is because companies can legally reimburse its nurses for certain expenses incurred while working away from home you. By Rachel Norton BSN RN. In most states bill rates tend to hover within a decent range.

41k salaries reported updated at October 15 2022. Please consult with a professional tax accountant to discuss your individual tax return. The expense of maintaining your tax home.

Here is an example. In California the bill rates can vary dramatically. Travel nurse earnings can have a tax advantage.

But many states including California use a percentage based approach to figuring out taxes due plus. Tax homes tax-free stipends hourly wages. Travel expenses from your tax home to your work.

How much do travel nurses make in California. Basically only income earned in California is taxed there. In fact theres no time like the present to learn from this years tax season to better prepare for a more prosperous futureespecially if youre a travel nurse.

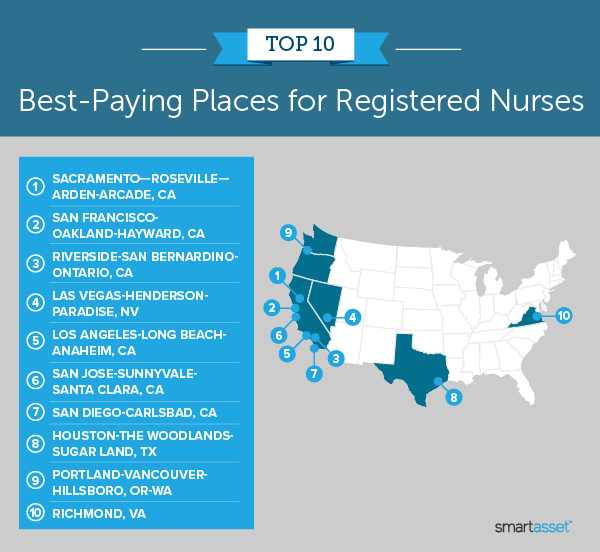

Two basic principles are at work here. According to ZipRecruiter the top locations for travel nurses are Los Angeles San Francisco San Diego and Sacramento. Not just at tax time.

Federal income taxes according to your tax bracket. First your home state will tax all income earned everywhere regardless of source. Travel nurses can no longer deduct travel-related expensesfood mileage.

To help you navigate your travel nurse taxes this year we spoke with Joseph Smith tax guru and president of TravelTax.

Travel Nurse Pay How Much We Really Make

Nurses Irs Filling Status Cure Healthcare Staffing

Rural Hospitals Losing Hundreds Of Staff To High Paid Traveling Nurse Jobs

Best Paying Places For Nurses 2021 Study Smartasset

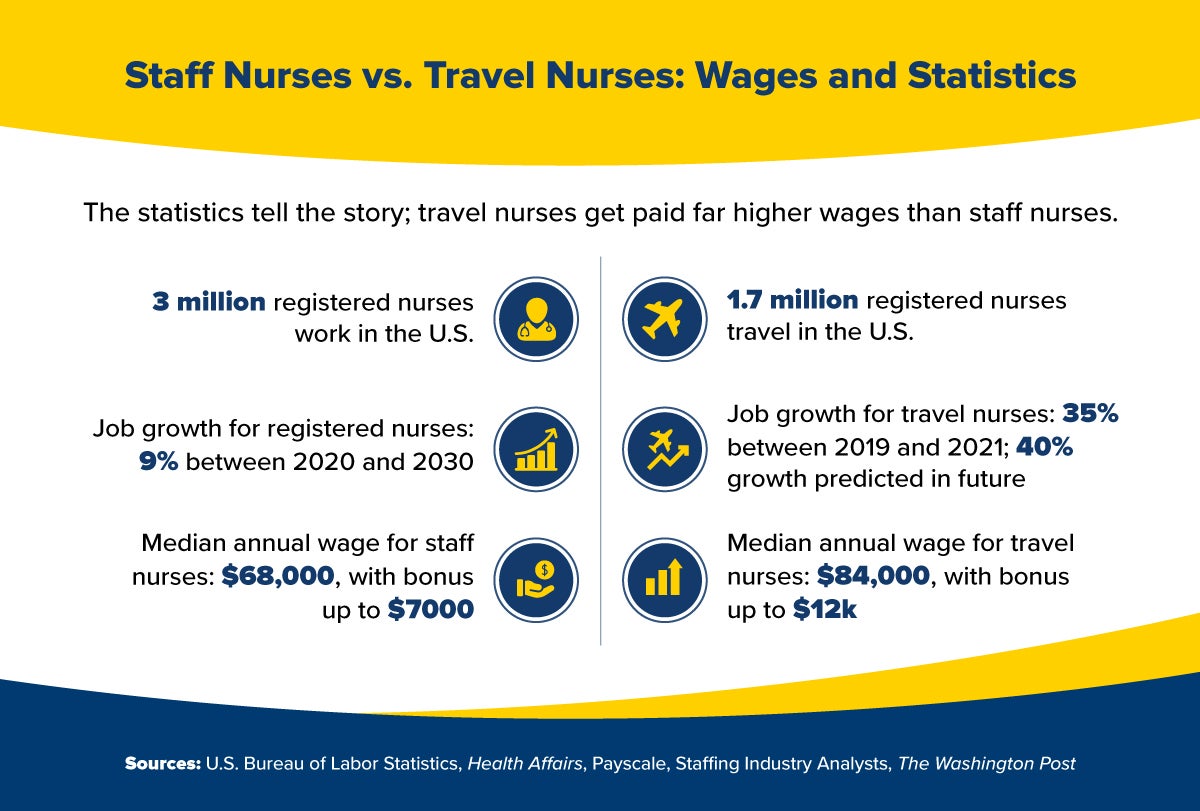

Travel Or Staff Nurse Who Makes More Trusted Nurse Staffing

Travel Nurse Housing Search Our Property Map To Find Furnished Housing Nationwide

Pros And Cons Of A Travel Nurse Spring Arbor University Online

How Taxes Work As A Travel Nurse

Top Tax Deductions For Nurses Rn Lpn More Everlance

Understanding Taxes As A Travel Nurse American Nurse

Travel Nursing Salaries Could Be Capped As Legislators Call For Investigation

Travel Nurse Pay Nearly Doubles Nationwide From Coronavirus Outbreak

Understanding 2021 Travel Nursing Tax Rules Nursefly Community Hub

Travel Nursing Tax Guide Wanderly

4 Must Know Rules To Tax Free Money As A Travel Nurse Nomadicare

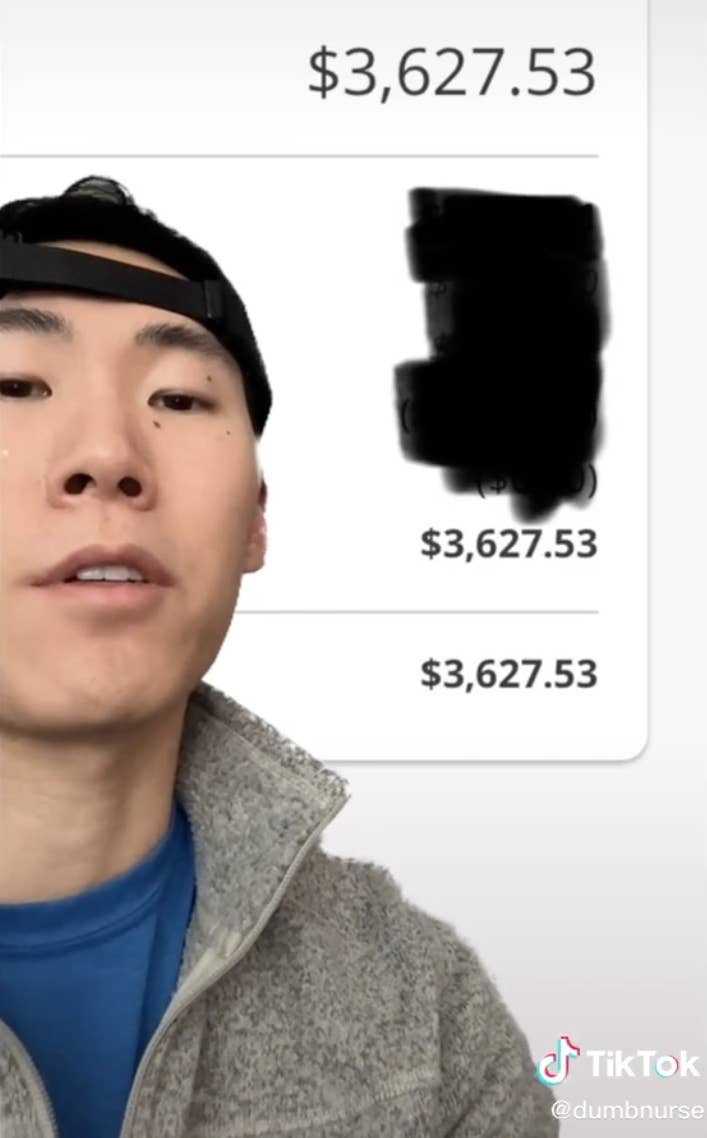

Tiktok Traveling Nurse Shares Salary

Nurse Shortages In California Reaching Crisis Point Calmatters